Say hello to our latest team members

As we wrap up the year, we’re excited to introduce the newest members of the CPiO and eSpida teams who have joined us in November and December. It’s...

Switchboard: 0344 880 61411 | Helpdesk: 0344 880 6155

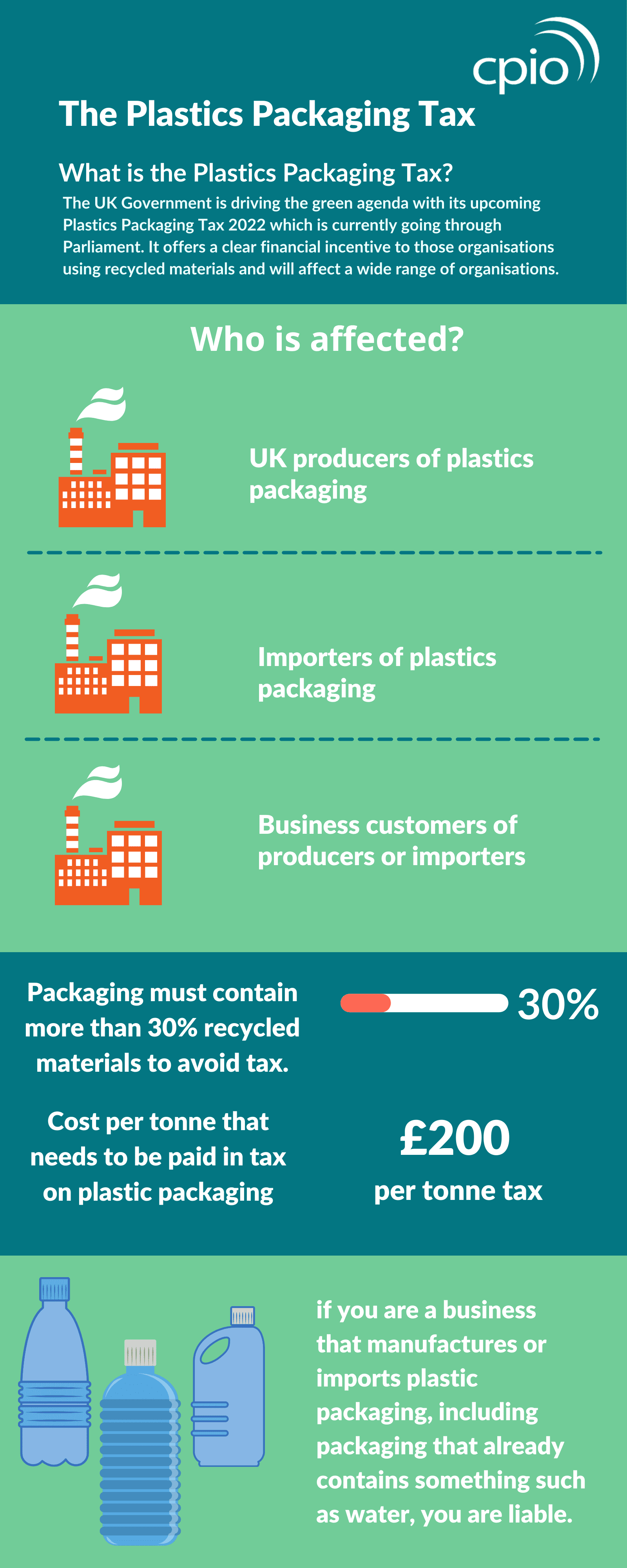

So, what is the Plastic Packaging Tax anyway?

We all remember the plastic bag tax which was effective in creating major change in the behaviour of consumers. The government is confident that the new Plastic Packaging Tax (PPT) will have similar effects on the behaviour of businesses. It is due to come into effect from the 1st of April 2022.

The new 30% recycled plastic threshold

This tax applies to plastic packaging, which is produced within, or imported into the UK containing less than 30% recycled plastic. The term ‘plastic packaging’ refers to packaging that is predominantly plastic in weight. The tax will therefore not apply to any packaging that is not predominantly plastic in weight, or which contains at least 30% recycled plastic. Whether filled or unfilled imported plastic packaging will be liable to the tax.

Facts about the Tax

How to prepare for the tax

If you are liable for the tax you will need to register your business on or before the April 2022 deadline. To prepare check if you need to keep records. Plastic packaging is assumed to not meet the recycled content test unless you are able to demonstrate that it does. Businesses must be able to measure the weight and % of recycled materials. If you sell packaging these items must be labelled with this information. Take into consideration that you may need to amend your paperwork such as invoices to show a customer how much Plastic Packaging Tax has been paid on the goods. Lastly consider your equipment must be able to record, analyse and report on those numbers.

Want more information? Visit HMRC: www.gov.uk/hmrc

-1.png)

As we wrap up the year, we’re excited to introduce the newest members of the CPiO and eSpida teams who have joined us in November and December. It’s...

.png)

CPiO has unveiled a new Sage X3 interactive product tour, designed to offer organisations a clearer, more practical view of the platform before...

Keep up to date with CPiO's latest blogs, news and events

.png)

The UK Government has announced that the rate of Plastic Packaging Tax (PPT) will increase in line with the Consumer Price Index (CPI). The new...

1 min read

CPiO has appointed UK eCommerce expert Richard Nash as Intellisell Product Manager. Richard has over 20 years of experience in the IT industry,...

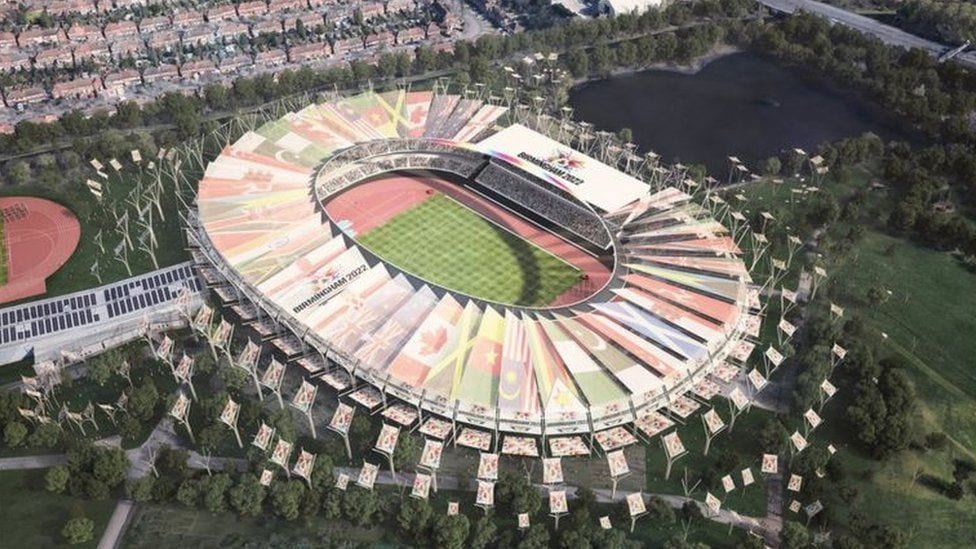

A recent survey by Copper Consultancy of around 1,000 people in Birmingham has revealed that nearly 75% of people are optimistic about the city’s...