Sage Ai for CFOs: From reporting to real-time intelligence

Today’s SaaS CFO is expected to be far more than a financial gatekeeper. They are strategic partners to the CEO, trusted voices for investors, and...

Switchboard: 0344 880 61411 | Helpdesk: 0344 880 6155

3 min read

CPiO Limited : Sep 30, 2025 12:51:59 PM

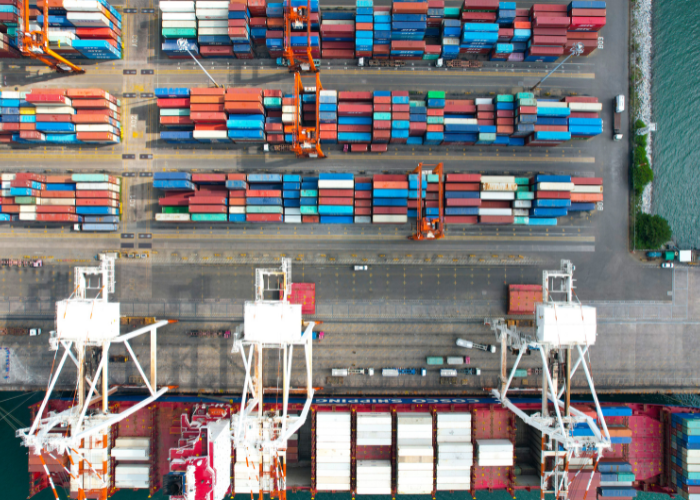

Chapter 1: The Impact of US trade tariffs on global markets

Recent US trade tariffs have disrupted businesses worldwide, creating significant challenges across international markets. Countries are responding differently: the UK and EU have implemented proactive trade negotiation strategies, resulting in moderate tariff rates of 10% and 15%, while Brazil faces a steep 50% tariff, and Switzerland was unexpectedly hit with a 39% levy.

The effects of these tariffs extend far beyond the immediate cost on goods. In today’s interconnected global supply chains, tariffs influence trade relationships, shipping volumes, delivery routes, and overall logistics expenses. Many US firms are adjusting their strategies by reducing international spending and focusing on domestic production, generating ripple effects that reshape global markets.

For businesses navigating international trade, understanding these dynamics is essential. Tariff shifts are redefining market strategies, operational planning, and long-term growth opportunities across industries.

To understand the impact of international trade tariffs on UK manufacturers to date, CPiO has surveyed the views and opinions of 250 UK Finance Decision Makers (FDMs) who work within the Manufacturing and Distribution or Logistics sectors with a minimum annual turnover of £1million or more.

Tariffs are reshaping how UK SMEs plan and forecast revenue, putting pressure on sales teams and decision-makers. A recent survey of UK SME Financial Decision Makers (FDMs) reveals the scale of the challenge:

Survey results: UK SMEs’ perception of supply chain risk after new trade tariffs

56% of UK SME Financial Decision Makers(FDM) have seen up to a 40% reduction in the sales pipeline.

68% of UK SME FDMs confirm a high impact on short and medium-term investment plans.

70% of UK SME FDMs report supply chain risks have increased.

23% of UK SME FDMs are paralysed with uncertainty in their financial forecasting models.

These findings show how tariffs create knock-on effects across prospecting, deal flow, and long-term planning. Businesses that build resilience into sales strategies — and stay agile as trade policies evolve — will be better positioned to protect revenue and maintain growth. Want to see the full insights from our survey? Download the full report to explore detailed findings and trends.

UK SMEs are increasingly impacted by international trade tariffs, with 70% of Financial Decision Makers (FDMs) reporting higher supply chain risks since recent tariff changes.

Key factors driving this pressure include:

US domestic manufacturing investments: Technology giants like Texas Instruments, NVIDIA, TSMC, and Apple are committing billions to increase production at home. This shift affects global supply chains, forcing raw materials and components to be rerouted.

East Asia manufacturing uncertainty: Traditional production markets may face lower demand and reduced inward investment, adding further supply chain unpredictability.

Shipping and logistics challenges: Adjustments in transportation routes for essential components increase complexity and risk across supply networks.

In a recent survey, UK SMEs were asked "In your opinion, what level of impact have the changes in international trade tariffs during recent months had on your organisation's short and medium-term investment plans?"

As a result, UK SMEs are taking precautionary measures, including reducing investment and increasing working capital, to maintain agility and resilience in an uncertain trade environment. Unlock the full report to explore the complete survey findings and insights on how UK SMEs are adapting to global tariffs.

Global trade tariffs are reshaping the way UK SMEs plan and invest.

To explore this shift, CPiO surveyed 250 finance decision-makers across UK manufacturing, logistics and distribution. The results highlight emerging trends that every small and medium-sized enterprise should watch.

Tariffs influence sales and supply chains – Respondents report that tariff changes are putting pressure on order volumes and increasing supply-chain risk.

Forecasting is under strain – Leaders say uncertainty around trade rules makes accurate financial planning more difficult.

Technology gaps limit visibility – Many SMEs are questioning whether their ERP and financial systems deliver the real-time insight needed for fast decisions.

Resilience strategies are taking shape – Companies are beginning to explore supplier diversification, data-driven forecasting tools and smarter use of capital. These headline findings provide a starting point for understanding how international tariffs are affecting UK business performance.

Those findings give us a pretty clear picture: tariffs aren’t just something happening in the background — they’re shaping sales, supply chains and even how leaders make investment calls.

So the next question is, how are businesses actually dealing with all that change?

In Chapter 2, we’ll look at how UK SMEs are navigating the impact of shifting trade tariffs — what’s working, what isn’t, and how they’re keeping their plans on track.

Today’s SaaS CFO is expected to be far more than a financial gatekeeper. They are strategic partners to the CEO, trusted voices for investors, and...

Independent research firm Information Services Group (ISG) has classified Sage X3 as a Leader in its evaluation of ERP solutions for midsized...

Independent analyst ISG has positioned Sage X3 as a Product Experience Leader for mid-sized manufacturing organisations.

Keep up to date with CPiO's latest blogs, news and events

Insights from Andrew Watkinson, Managing Director at CPiO, on navigating tariffs, supply chain risks, and financial uncertainty

International trade tariffs are reshaping the way UK small and medium-sized enterprises (SMEs) operate. From supply chain costs to customer pricing,...

What does a traditional BI set up typically look like in an organisation compared to visualisation? Undoubtedly it will be all about centralised...